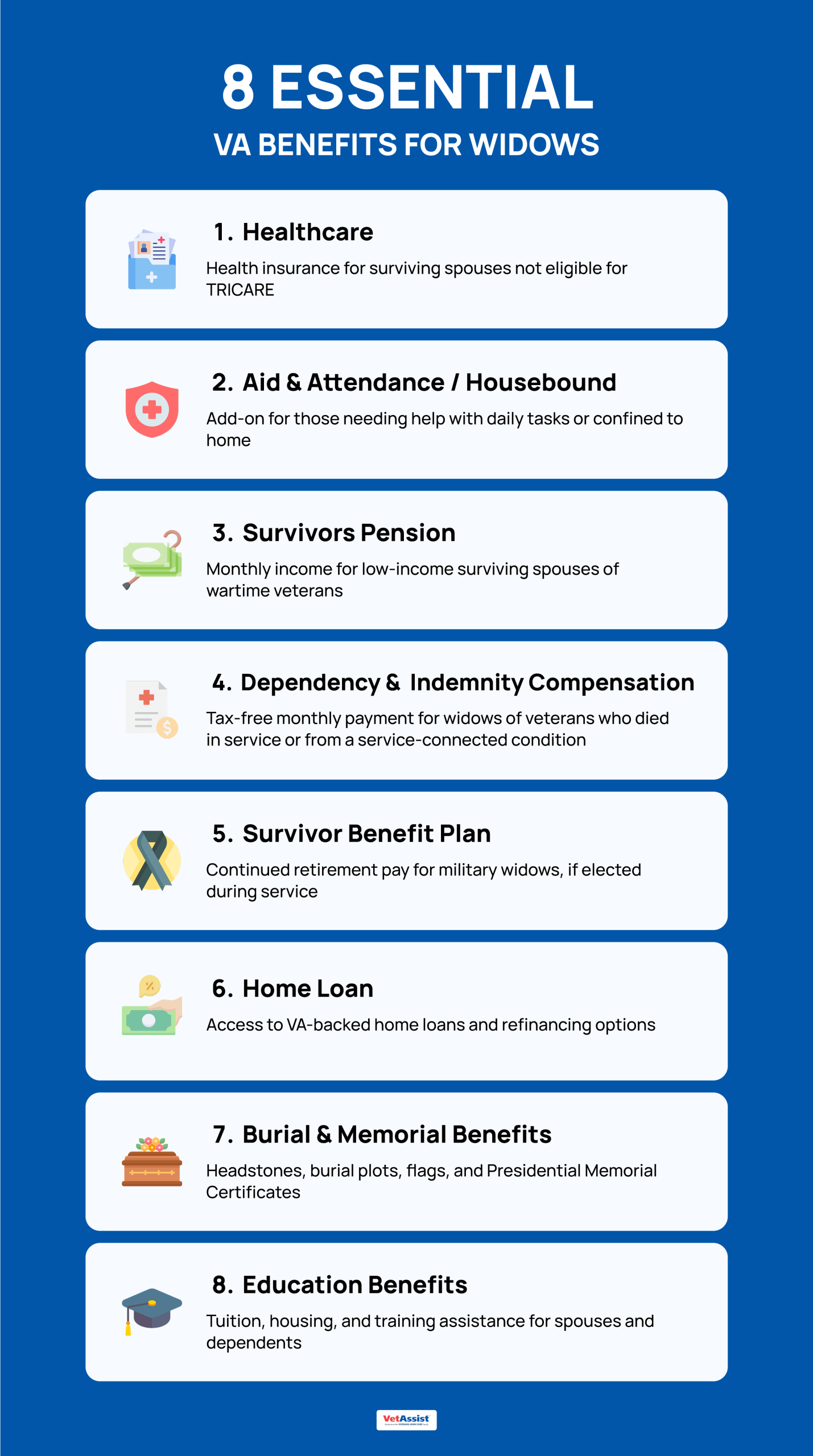

8 Essential VA Benefits for Widows

The VA offers a wide range of benefits for surviving spouses of veterans. Veteran spouse benefits include healthcare, financial counseling/home loan assistance, compensation for service-related death, and other specialized programs. Some veterans’ benefits for surviving spouses are also available to them while their veteran spouse is still alive. Increasing the visibility of these programs can ensure our veteran spouses receive important benefits to which they are entitled.

All VA benefits for spouses must be applied for and require supporting documentation; they are unfortunately not automatically distributed. That said, veterans’ widow benefits make a big difference for surviving spouses and their families, especially when it comes to home care services and healthcare coverage.

What follows is a list of some of the most relevant benefits for surviving spouses.

1. Healthcare

In addition to widows and widowers, the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) is also available to spouses of living veterans. Eligibility depends on a few factors:

In addition to widows and widowers, the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) is also available to spouses of living veterans. Eligibility depends on a few factors:

The living veteran must have been permanently and totally disabled in connection with their military service, or—

the veteran must have died from or with a service-connected disability, or—

the veteran must have died in the line of duty.

If any one of the above is true, the veteran spouse may qualify for CHAMPVA. (Note that when the last point is true, most veteran spouses will qualify for TRICARE instead, which is a program for military personnel as well as their dependents.) CHAMPVA covers most healthcare costs for those who are enrolled and includes pharmacy benefits, including Meds by Mail.

2. Aid and Attendance

The Aid and Attendance benefit is also available to spouses of living veterans. Aid and Attendance is an underused benefit that reimburses families for costs associated with care for basic needs (or ADLs, as defined by the VA). This is an essential resource for older or disabled veterans and their surviving spouses who need assistance with dressing, bathing, moving around the house, preparing meals, and similar activities. It is especially useful because recipients may stay in their own homes, and costs are covered whether their caregiver is a professional, a family member, or a friend.

The Aid and Attendance benefit is also available to spouses of living veterans. Aid and Attendance is an underused benefit that reimburses families for costs associated with care for basic needs (or ADLs, as defined by the VA). This is an essential resource for older or disabled veterans and their surviving spouses who need assistance with dressing, bathing, moving around the house, preparing meals, and similar activities. It is especially useful because recipients may stay in their own homes, and costs are covered whether their caregiver is a professional, a family member, or a friend.

To qualify, veterans’ widows must have been married to them at the time of the veteran’s death, or if divorced, must not have remarried. Other eligibility requirements may be found here, or fill out this form to quickly learn if you are eligible.

3. The VA Survivors Pension

This income-focused benefit is strictly for surviving spouses who have not remarried and offers a monthly payment to cover costs of living. Eligibility for this benefit depends on net worth and yearly family income limits, as well as wartime service periods.

This income-focused benefit is strictly for surviving spouses who have not remarried and offers a monthly payment to cover costs of living. Eligibility for this benefit depends on net worth and yearly family income limits, as well as wartime service periods.

4. Dependency and Indemnity Compensation (DIC)

This benefit offers a tax-free monthly payment to help cover the surviving spouse’s costs of living when their veteran spouse has died in active duty or due to injuries/disability from active duty. (It may also be collected by the veteran’s child or parent, if qualifications are met.) There are stipulations around marital status, which you can read here.

This benefit offers a tax-free monthly payment to help cover the surviving spouse’s costs of living when their veteran spouse has died in active duty or due to injuries/disability from active duty. (It may also be collected by the veteran’s child or parent, if qualifications are met.) There are stipulations around marital status, which you can read here.

5. Accrued Benefits and Substitution

In many cases, if the veteran passed away while waiting for the VA to decide on and distribute a benefit, the surviving spouse may collect the entire benefit awarded, even retroactively. These are known as accrued benefits because there is sometimes a significant length of time in between the date of death and the date of benefit award; the spouse is entitled to the benefits that were never paid out from the date of award. If the claim is still pending, the spouse may simply substitute in on the application while waiting for the decision.

In many cases, if the veteran passed away while waiting for the VA to decide on and distribute a benefit, the surviving spouse may collect the entire benefit awarded, even retroactively. These are known as accrued benefits because there is sometimes a significant length of time in between the date of death and the date of benefit award; the spouse is entitled to the benefits that were never paid out from the date of award. If the claim is still pending, the spouse may simply substitute in on the application while waiting for the decision.

The spouse has one year from the veteran’s death or the VA’s notification of the decision to file a claim. Links to the relevant forms are provided by the VA here.

6. Home Loans

The VA backs home loans with more advantageous terms that are available to widows and widowers of veterans, provided they present a Certificate of Eligibility (COE). COE requirements can be found here. These loans may apply to a new home purchase, cash-out refinancing, or an interest rate reduction refinancing. The same program also offers financial counseling for those who are having trouble making their mortgage payments on a VA-backed loan, helping them avoid foreclosure and stay in their home.

The VA backs home loans with more advantageous terms that are available to widows and widowers of veterans, provided they present a Certificate of Eligibility (COE). COE requirements can be found here. These loans may apply to a new home purchase, cash-out refinancing, or an interest rate reduction refinancing. The same program also offers financial counseling for those who are having trouble making their mortgage payments on a VA-backed loan, helping them avoid foreclosure and stay in their home.

(In addition, for living veterans who have specially modified their home to accommodate a service-connected disability, Veterans’ Mortgage Life Insurance—VMLI—offers a way to pay your mortgage upon the death of the insured person.)

7. Burial and Memorial

Other veterans’ benefits for surviving spouses cover burial and funeral costs, where they may be buried in a national cemetery and receive a headstone or marker, as well as perpetual gravesite care. The widow or widower does not necessarily have to be buried in the same cemetery as their veteran spouse, nor are they excluded from this benefit if their spouse was not interred in a national cemetery.

Other veterans’ benefits for surviving spouses cover burial and funeral costs, where they may be buried in a national cemetery and receive a headstone or marker, as well as perpetual gravesite care. The widow or widower does not necessarily have to be buried in the same cemetery as their veteran spouse, nor are they excluded from this benefit if their spouse was not interred in a national cemetery.

There is an additional burial allowance available to some spouses (eligibility requirements here) that covers transportation to and from the burial site and other related costs.

8. Education

As a first consideration, military personnel may transfer their GI Bill benefits to their spouse or child. In other cases, surviving spouses may receive monthly payments to cover college tuition or on-the-job training through the Survivors’ and Dependents’ Educational Assistance (DEA) program. DEA eligibility depends on certain conditions for the veteran and for the surviving spouse. Benefits are available for 10 years after eligibility (or 20 years if the veteran spouse died on active duty or was rated permanently and totally disabled).

As a first consideration, military personnel may transfer their GI Bill benefits to their spouse or child. In other cases, surviving spouses may receive monthly payments to cover college tuition or on-the-job training through the Survivors’ and Dependents’ Educational Assistance (DEA) program. DEA eligibility depends on certain conditions for the veteran and for the surviving spouse. Benefits are available for 10 years after eligibility (or 20 years if the veteran spouse died on active duty or was rated permanently and totally disabled).

An alternative to DEA, the Fry Scholarship is available to those whose veteran spouse died in the line of duty or from a service-connected disability on or after September 11, 2001. The surviving spouse may only be eligible if they have not remarried. The Fry Scholarship pays up to 36 months in education benefits for tuition, housing, and books.

Surviving spouses may choose between DEA or the Fry Scholarship, but they cannot use both. They can, however, use either one while they are also collecting DIC.

All veteran spouse benefits hinge on the veteran’s eligibility, meaning they cannot have been dishonorably discharged. Veteran families are encouraged to explore the benefits to which surviving spouses are entitled. Whether it’s assistance in advanced age, reliable healthcare, or improved quality of life, VA programs exist to honor our heroes’ sacrifices—and those of their loved ones.

If your loved one needs home care, our VetAssist mission is to make home care easily and quickly accessible for those who qualify through the VA Pension with Aid and Attendance benefit. Veterans Home Care can help you determine whether you or your loved one will be eligible to receive the benefit, which can cover some or all of the cost of home care, and we make it easy to apply. Chat with us via our website, or call us at (888) 314-6075.