Understanding the Difference between a VA Pension and VA Disability Compensation

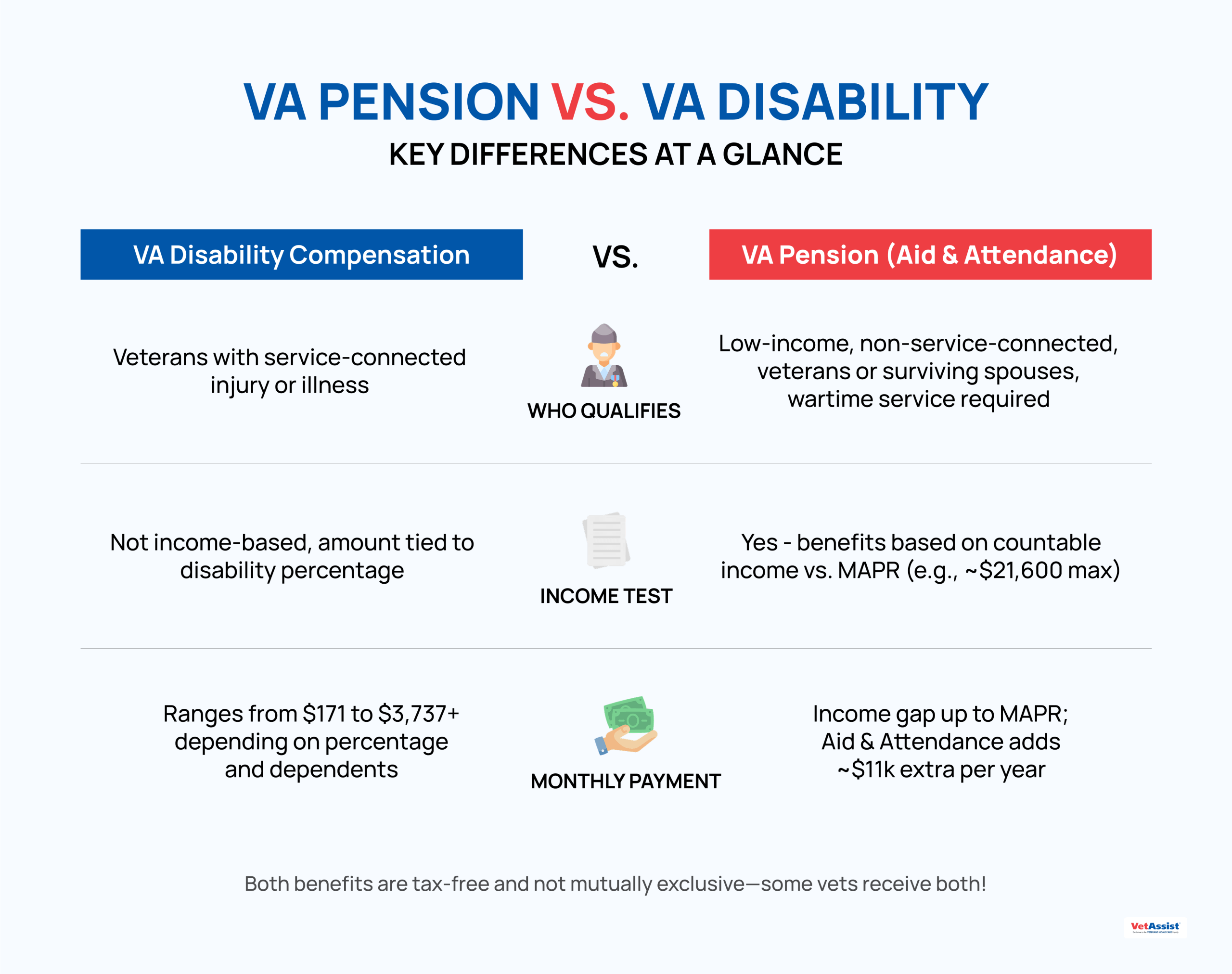

“VA pension” and “VA disability” are sometimes used interchangeably, but they are not the same thing. While both are tax-free, monthly cash disbursements to qualifying veterans and their dependents, they hold different eligibility requirements. Here, we discuss VA pension vs. VA disability with a summary of the purpose and qualifications for each.

What Are VA Disability Benefits?

The disabled veteran pension is a VA compensation-type benefit for those veterans whose employment is impacted by a service-related injury or illness. The operative prerequisite here is “service-related.”

Similar to a worker’s compensation benefit, it provides monthly financial support for veterans whose ability to work has been impacted by a disability connected to their military service. Note that disability benefits are not affected by how much a veteran household earns per year (unlike VA pensions, which are discussed below).

A service-related disability could result from one or more of the following circumstances:

- You were injured during military service (with exclusions for willful misconduct)

- You had an injury that was directly worsened by your military service

- Your disability developed from another, prior condition that was caused by military service (called a secondary disability)

- You developed an injury or illness after military service that can be linked back to your service (according to related laws, such as the Blue Water Navy Act of 2019 or the PACT Act of 2022)

- Your disability developed due to VA medical negligence

- There is no specific age or income requirement for this type of pension, but the disability must be proven to be service-connected.

Disabilities covered can range widely—from cancer to lost limb to post-traumatic stress disorder (PTSD) and more.

Veterans’ disability pension rates currently range from $171.23/month to $3,737.85/month for a veteran with no spouse or dependents. Pension awards vary according to the impact of the disability on the veteran’s ability to work. They are calculated on a 10% increment basis, meaning you may receive 10%, 20%, 30%, and so on up to 100% of the pension benefit. At upper levels, monthly payouts increase for veterans with dependents, including children or parents.

What Are VA Pension Benefits?

Veterans’ pension benefits are designed to supplement income and alleviate hardship for low-income veterans. A veteran may qualify for a VA pension regardless of their disability status, as the main qualifications are around financial need and dates of service. VA pensions are, however, an excellent resource for veterans who are disabled when the disability is not service-connected.

VA pension eligibility requirements include:

- Any discharge status other than dishonorable

- Active duty service for a prescribed length of time (details here)

- A qualifying annual income and net worth

In addition to meeting the requirements above, you must also meet one of the following:

- Be age 65 or older

- Have a permanent, total disability

- Be in nursing home care for a disability

- Receive Social Security Disability Insurance or Supplemental Security Income

Veterans’ pension rates vary by income calculated against the Maximum Annual Pension Rate (MAPR) set by Congress. As an example, the current MAPR for a veteran who is not housebound and who has a dependent spouse is $21,674; to get your pension rate, subtract your annual income from this figure. A full listing of current rates is provided here by the VA.

Note that income includes wages and Social Security checks, among others, but the VA may deduct from your income certain medical expenses that you pay out of pocket as long as they make up 5% or more of your income. There is also a cap on net worth, which includes some assets but not the veteran’s home or car. The current net worth cap through November of 2024 is $155,356.

VA Pension Additional Benefits

The Survivors Pension offers financial support to spouses or dependent children of deceased wartime veterans. There are financial eligibility requirements similar to those described above, and the surviving spouse or child must be unmarried to receive the benefit.

Many veterans who qualify a pension also qualify for an underutilized benefit called Aid and Attendance. Aid and Attendance also covers veteran spouses, even after the veteran is deceased. This add-on specifically covers long term care for chronic conditions and aid for the Activities of Daily Living (ADLs) such as bathing and eating. In the above example of a veteran with a dependent spouse, qualifying for Aid and Attendance bumps their MAPR from $21,674 to $32,729.

Aid and Attendance can greatly impact families where a spouse, child, or other family member is acting as a caregiver for the veteran, as it offers the resources to pay for professional and respite care. The benefit is not well-known, but is growing in popularity. Upon being awarded Aid and Attendance, continued compliance is required to keep the benefit.

The VetAssist Program exists to serve veterans and their families by making home care easily and quickly accessible for those who qualify through the VA Pension with Aid and Attendance benefit. Veterans Home Care can help you determine whether you or your loved one will be eligible to receive the benefit, which can cover some or all of the cost of home care, and we make it easy to apply. Chat with us via our website, or call us at (888) 314-6075.